Unfortunately late payment is a problem faced by businesses of all shapes and sizes everyday, and the current economic environment is only making things worse. You may be following all of the strategies we’ve mentioned in earlier blogs, but customers still aren’t paying their bills. You send invoices, statements, make calls, send emails, but they’re all ignored or you’re told over and over that the money is coming, but it doesn’t arrive.

Once in-house efforts have been exhausted, any dispute has been resolved and the debt remains outstanding, it’s time to consider further action. You could take legal action at this stage, but you should first consider the customer relationship – what impact would it have if you issue a solicitors letter before action or a statutory demand (depending on the size of the debt)?

It’s circa 70% more efficient to sell to an existing customer, than it is to find a new one. Sure, they owe you money and any future trading relationship would need to take into account their late payment, but there could be a legitimate reason behind the late payment that they’re too embarrassed to share with you. They may be a victim of fraud, late payment or bad debt themselves or they may have lost a key customer as a result of insolvency.

When a business falls into financial distress or fails to pay its invoices, a domino effect is triggered and all parts of the supply chain start to suffer. Suppliers are impacted when invoices go unpaid as it may mean that they are unable to pay their suppliers for goods and services and so on and so on. If this is starting to sound familiar or you notice any of the below, you may benefit from the help of a debt collection agency.

You've found that you're spending too much time speaking to the same customer and you're getting no further.

The customer has raised a dispute, which you have reviewed and rectified (where applicable), but payment isn't made and/or they continue to dispute the debt.

You have agreed a payment plan, but the customer is not sticking to it and the payments are sporadic or worse still, not being made at all.

The customer has a track record of poor payment performance, but it's gotten worse.

Your credit insurance policy (where applicable) states that you must take further action by a pre-agreed date in order to comply with the terms.

You believe they are in financial distress.

You have a new customer and they have not responded to your efforts to contact them regarding the overdue account.

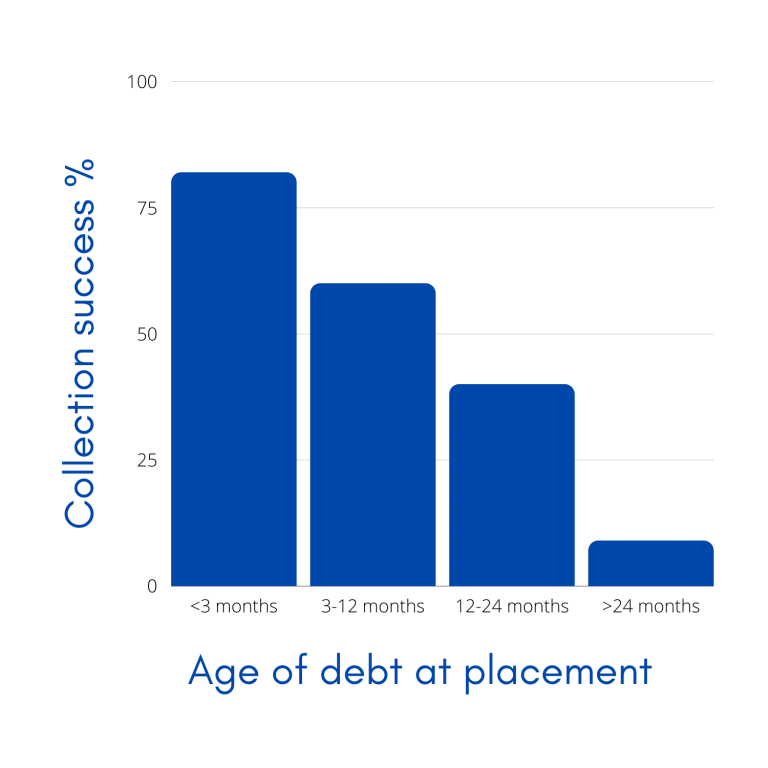

The most important thing to consider when using a debt collection agency is timing. Experience tells us that commercial debt placed within three months of the due date can expect to have a collection success rate of 82%, and as you will see from the graph, the longer a debt is outstanding before it is placed for collection, the less collectable it is.

How can a debt collection agency help?

Debt collection and recovery agents are companies specialised in securing payments of unpaid invoices on behalf of their clients. By many they are considered as an extension to the credit control process and they can be a very effective tool to helping you to avoid a bad debt. Their job is simple, to get you paid.

What does a debt collection agency do?

Debt collection agencies usually follow a process which is very similar to the credit control process mentioned in our earlier blog. It’s their job to negotiate with your customer on your behalf, to find a resolution which is acceptable to both parties. This is done by reenforcing your statutory rights to take action and taking the emotion out of the situation.

Customers are more likely to respond to the demands of a third party as they’re outside of the relationship. Using a debt collection agency can actually help to alleviate further strain on the relationship. After all, companies owe money, but people pay bills.

Why Ko-bolt?

With so many debt collection agencies in the market, why choose Commercial Debt Collection from Ko-bolt?

We're specialists

We don't offer consumer debt collection. Consequently, by focusing only on commercial debt collection, we can deliver the best service and the best results.

Our approach

Our debt collection process focuses on the buyer-supplier relationship. As a result, you can expect swift recovery and the opportunity to engage in future trade.

No collect, no fee

Our service is always offered on a no collection, no commission basis. Therefore, you only pay if we're successful in securing payment. Sound fair?